Why Wero matters for Shopify stores

Wero introduces a single European bank payment option built for trust. Shoppers pay directly from their bank account. The flow stays fast and familiar, with confirmation inside the banking app. Ecommerce support arrives late 2025 or early 2026 in phases.

Practical takeaway: You can plan early. You avoid rushed changes. You protect checkout stability during peak periods.

Why bank payments improve Shopify performance

European shoppers often prefer bank payments, especially in the Netherlands, Germany, France, and Belgium. When your checkout matches local habits, more shoppers finish orders. Card flows can add declines and extra steps. Bank payments reduce friction and improve completion.

-

Fewer failed checkouts

Funds move directly. Confirmation happens quickly. You reduce “try again” moments.

-

Higher trust at the point of payment

Customers recognize their bank. Security signals stay strong. Hesitation drops.

-

Better cross border readiness

One experience across markets reduces operational overhead for expansion.

How Wero improves checkout on Shopify

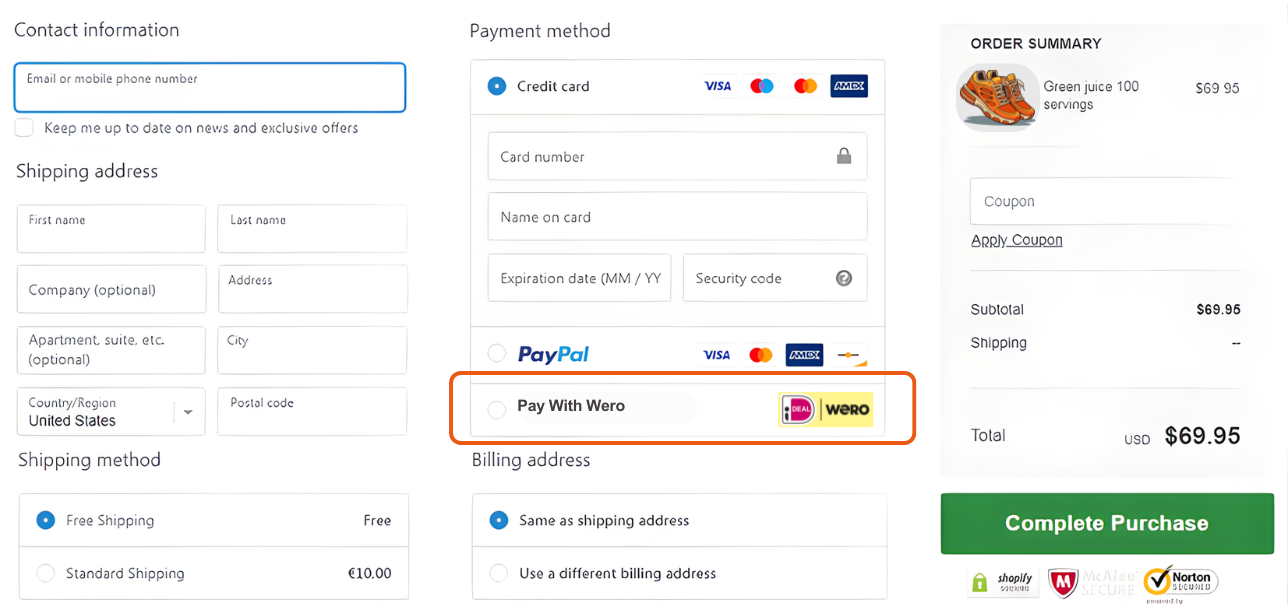

Wero creates one consistent bank payment experience across European markets. Shopify merchants avoid managing multiple local methods. Customers select Wero in checkout, confirm in their bank app, then return to your store instantly. The flow feels familiar and abandonment drops.

iDEAL transition to Wero for Shopify merchants

The Netherlands plays a key role in the rollout. iDEAL transitions into Wero through a structured upgrade plan. During early stages, checkout can display iDEAL | Wero together. Payment behavior stays unchanged while customers get used to the new branding.

Why this upgrade supports Shopify growth

One European payment method can reduce reliance on multiple local options over time. Reporting becomes simpler. Reconciliation takes less effort. Support issues reduce. Stores expanding into new markets benefit most because Wero expansion keeps your checkout ready without new integrations.

European banks supporting Wero

Wero is backed by major European banks through the European Payments Initiative. This builds trust at checkout. Customers recognize their bank and feel confident. Payment service partners also support the ecosystem, including Worldline for processing and Nexi for acquiring.

| Country

| Banks (examples listed)

|

|---|

| Netherlands and Belgium | Argenta, Bank Van Breda, Belfius, Beobank, BNP Paribas Fortis, Crelan, ING Belgium, KBC, CBC, Revolut, vdk bank

|

| France | BNP Paribas, Groupe BPCE, Crédit Agricole, Crédit Lyonnais LCL, Crédit Mutuel, Fortuneo, Hello bank, La Banque Postale, Société Générale

|

| Germany | BBBank, Postbank, ING Germany, PSD Bank, Sparkassen Finanzgruppe, Volksbanken Raiffeisenbanken

|

| Luxembourg | Banque Internationale à Luxembourg, Banque Raiffeisen, Post Luxembourg, BGL BNP Paribas, Spuerkeess

|

| Partners | Worldline (processing), Nexi (acquiring)

|

What customers experience during the change

Customers continue paying through their bank with familiar steps. Login stays inside the banking app. Confirmation appears quickly. Branding changes before functionality changes, which protects trust. Customers do not need to learn a new flow so checkout confidence stays high.

What changes in the checkout flow

A new logo can appear during the transition, and iDEAL and Wero may display together. This signals the shift. Payment speed and the core flow remain the same. Security indicators stay visible. Customers do not see extra screens, so the checkout stays smooth.

What stays the same for merchants

Your payment provider setup stays unchanged in early phases. You do not need new configuration work. You avoid theme updates. Settlement timing stays consistent. Reporting tools remain familiar. Refund processes stay the same. Daily operations continue without disruption while systems transition behind the scenes.

What happens behind the scenes

The technical transition happens gradually. New Wero infrastructure runs alongside existing systems. Traffic shifts step by step with active monitoring. CartDNA coordinates across providers and supports testing before each phase. Stability stays the priority so your store keeps selling without surprises.

How you prepare without risk

Preparation starts early but stays light. You review CartDNA updates, then test payment flows when available. Keep teams aligned on branding and support messaging. Avoid changes during peak season. Planning protects revenue, reduces fire drills, and keeps performance steady.

-

Track rollout updates

Share timing notes with ecommerce, finance, and support. Keep one internal owner.

-

Test checkout flows

Validate success, refunds, and failure paths. Use real devices and bank apps.

-

Prepare support scripts

Explain branding changes first. Confirm the flow stays the same.

How CartDNA supports merchants

CartDNA shares timelines early, provides branding guidance, and gives instructions only when action is needed. Support stays available throughout the rollout and questions get fast answers. You stay in control with fewer moving parts and a stable checkout experience across markets.

What this means for your business

You gain a unified European bank payment method over time. Complexity reduces. Maintenance effort drops. Expansion barriers lower. Trust improves at checkout with familiar bank flows. Completed orders can increase as hesitation and payment failures drop. Revenue stability improves across markets.

Timeline note: Full Wero availability in the Netherlands is expected in early 2026, and the iDEAL migration completes by end of 2027 through phased change.