Online shopping habits are changing rapidly. Card payments no longer dominate every region. Today’s shoppers expect payment options that match local behavior and trust patterns. When a checkout does not show a familiar payment method, conversions drop.

Many merchants report higher checkout completion after adding alternative payment methods. This shift is visible across Europe, Asia, Latin America, and parts of the Middle East. Data from payment providers and Shopify merchants confirms this trend.

This article explains why alternative payment methods outperform cards in specific markets and what ecommerce businesses should do next.

Changing shopper payment behavior

Consumers prioritize speed, trust, and familiarity at checkout. Traditional card payments do not always deliver these qualities. In many regions, local wallets and bank transfers feel safer and easier.

Some markets are mobile-first, where wallets dominate. Others prefer direct bank payments due to lower fees and stronger fraud controls.

Key drivers behind this shift include:

Mobile-first ecommerce growth

Local trust in regional payment brands

Lower decline rates on local payment methods

Limited card access in emerging markets

Regulatory pressure on card processing

A one-size-fits-all checkout no longer works across borders.

Why cards underperform in some markets

Card adoption and trust vary widely by region. In Germany, cards never became the preferred method for online payments. In the Netherlands, bank transfers dominate. In India, wallets and UPI handle daily transactions.

When shoppers reach checkout and see only card options, hesitation increases and abandonment follows.

Common card-related issues include:

High decline rates for cross-border transactions

Extra authentication steps that add friction

Fraud concerns for first-time buyers

Low card ownership in certain demographics

Each failed payment attempt directly impacts revenue.

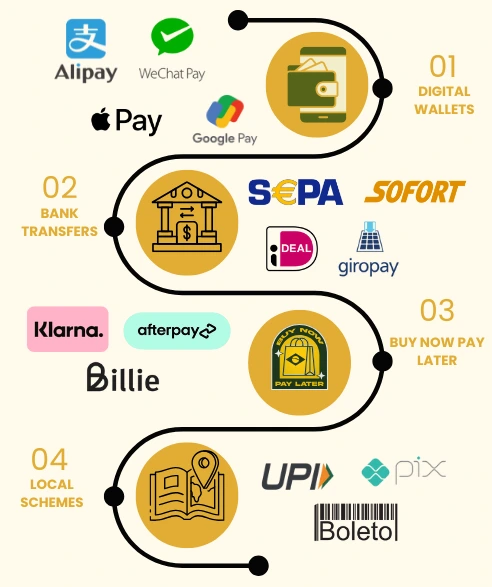

Alternative payment methods explained

Alternative payment methods include digital wallets, bank transfers, buy now pay later services, cash-based vouchers, and region-specific payment schemes.

These options integrate directly into Shopify checkout through approved payment apps.

Popular categories include:

- Digital wallets: Alipay, WeChat Pay, Apple Pay, Google Pay

- Bank transfers: SEPA, iDEAL, Sofort, Giropay

- Buy now pay later: Klarna, Afterpay, Billie

- Local schemes: UPI, PIX, Boleto

These methods reflect everyday payment behavior, increasing

Conversion data from real markets

Payment providers and Shopify merchants report significant conversion gains after adding alternative payment methods.

Examples from global markets:

Germany: Stores offering Sofort and SEPA transfers report conversion increases of over 20 percent compared to card-only checkout.

Netherlands: iDEAL accounts for more than half of online transactions.

India: UPI wallets outperform cards due to faster authentication.

Brazil: PIX and Boleto lead due to trust and accessibility.

Southeast Asia: E-wallets dominate mobile checkout flows.

Payment choice directly impacts conversion performance.

Trust plays a central role

Trust determines checkout success. Shoppers trust payment methods they use daily. Local payment logos provide reassurance, while unfamiliar processors raise concern.

Trust signals from alternative payment methods include:

Strong local brand recognition

Familiar authentication processes

Clear confirmation screens

Reduced fear of fraud

Higher trust leads to higher payment completion.

Mobile checkout and speed

Mobile traffic dominates ecommerce sessions. Cards perform poorly on mobile due to manual data entry and longer checkout flows.

Wallets and local methods reduce friction and improve speed.

Mobile payment advantages include:

Faster payment confirmation

Fewer input fields

Biometric authentication

Lower error rates

Speed matters. Delays cost sales.

Buy now pay later impact

Buy now pay later services attract budget-conscious and younger shoppers. These options allow flexible payments without traditional credit cards.

Observed benefits include:

Higher average order value

Reduced cart abandonment

Improved repeat purchase rates

Fashion, electronics, and lifestyle brands benefit the most.

Cross-border ecommerce growth

Global expansion exposes payment limitations. Cards frequently fail across borders, while regional payment methods improve acceptance.

Cross-border challenges solved by alternative payments include:

Local currency support

Reduced foreign transaction declines

Compliance with regional regulations

Improved settlement reliability

Flexible payment coverage is essential for global growth.

Role of Shopify payment apps

Shopify merchants rely on approved payment apps for seamless checkout integration. Native checkout support builds trust and avoids redirects.

Strong payment apps provide:

Native Shopify checkout integration

PCI-compliant infrastructure

Multi-currency support

Local payment method coverage

Stable and scalable APIs

Choosing the right payment partner directly affects conversion.

Why CartDNA fits the needs of global Shopify merchants

CartDNA focuses exclusively on Shopify payment app development, with deep expertise in alternative payment methods across global markets.

Merchants gain access to over 720 payment methods, support for more than 200 currencies, and coverage across 95 plus local markets through Shopify-approved apps.

This approach helps stores align with local payment habits, reduce checkout friction, and improve conversion rates without disrupting native Shopify checkout.

Where CartDNA fits in

CartDNA operates as a Shopify Payment App Development Partner. The platform focuses on alternative payment integration for global merchants. CartDNA connects Shopify stores with local and global payment methods through approved apps.

CartDNA highlights include:

Shopify certified partner status

PCI compliant infrastructure

Integration of over 720 payment methods

Support for over 200 currencies

Coverage across more than 95 local markets

These capabilities help merchants match local payment demand.

Practical example for merchants

A Shopify apparel store expands into Germany and the Netherlands using a card-only checkout. Conversion remains low.

After adding SEPA, Sofort, and iDEAL through a native Shopify payment app, checkout completion increases and payment-related support tickets drop.

Revenue improves without additional traffic.

Action steps for merchants

Review top traffic regions in analytics

Identify local payment preferences

Add alternative payment methods through approved app

Track conversion rates by payment type

Optimize mobile checkout performance

Each step supports measurable revenue gains.

Why payment orchestration matters

Managing multiple payment methods requires strong infrastructure. Fragmented setups create errors and inconsistencies.

Payment orchestration benefits include:

Unified reporting and reconciliation

Consistent checkout experience

Faster deployment of new payment methods

Improved fraud monitoring

CartDNA builds Shopify payment apps designed around these needs.

SEO relevance for ecommerce brands

Search engines reward strong user experience. Payment flexibility improves engagement metrics and reduces checkout exits.

SEO-friendly outcomes include:

Higher engagement rates

Lower bounce and abandonment rates

Improved regional relevance

Payment strategy directly influences visibility.

Alternative payment methods drive higher conversion rates in many global markets.

Cards alone no longer meet global checkout expectations. Local trust, mobile speed, and payment familiarity determine success.

Merchants offering regional payment options see measurable gains in conversion and revenue. Shopify store owners expanding globally need partners focused on local payment methods.

Platforms like CartDNA support this shift through certified Shopify apps and broad payment coverage. Payment choice now plays a direct role in ecommerce performance.