What Payment Orchestration Means for Shopify

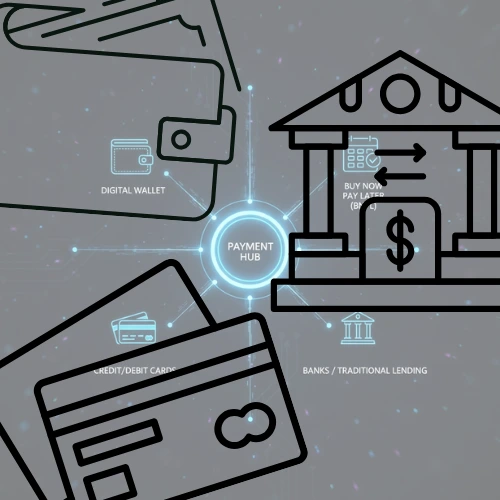

Payment orchestration connects multiple payment providers through one system. Merchants manage cards, wallets, bank transfers, and BNPL options from one setup. Shopify merchants use orchestration to avoid dependency on a single gateway. This approach reduces failed payments and improves flexibility.

Shopify growth pushes merchants toward these tools. Global sales demand local payment choices.

- One integration for many payment methods

- Smart routing based on location or currency

- Centralized reporting and reconciliation

- Built-in compliance and security controls

Why Shopify Merchants Move Beyond Single Gateways

Many stores start with default payment options. Growth exposes limits quickly. Approval rates drop in new regions. Customers abandon carts when local methods remain unavailable. One gateway outage can block all sales.

Payment orchestration addresses these problems through choice and control.

Common issues merchants face

Limited access to local wallets or bank schemes

Higher fees from single providers

No backup during downtime

Impact on Checkout Experience

Checkout speed and familiarity drive conversions. Payment orchestration supports native Shopify checkout flows. Customers see trusted options without redirects. Fewer steps lead to higher completion rates.

Global commerce data shows more than half of shoppers abandon checkout when preferred payment methods are unavailable. Local wallets and bank transfers build confidence.

Reginal examples

The Netherlands relies on iDEAL

Asian markets expect regional wallets

UK shoppers use cards and BNPL options

Revenue Effects for Growing Stores

Payment orchestration increases successful transactions. Smart routing sends payments to the best-performing provider. Approval rates rise while failed payments decline.

Revenue benefits list

Lower cart abandonment

Reduced processing fees

Improved fraud detection

Operational Control and Reporting

Managing payments across regions adds complexity. Orchestration platforms centralize transaction data. Merchants track payments, refunds, and disputes from a single dashboard.

Reporting benefits list

Faster reconciliation

Clear fee visibility

Actionable market-level insights

Security and Compliance Standards

Security features list

3D Secure support

Fraud monitoring tools

Webhook and API safeguards

Role of Specialized Shopify Payment Partners

Payment orchestration requires Shopify expertise. Not every provider understands platform rules or approval processes. Certified partners focus on native integrations.

CartDNA operates as a Shopify Payment App Development Partner, connecting global payment solutions through approved Shopify apps.

CartDNA highlights

Level D PCI compliance

Integration with 70+ merchant acquirers

Support for 720+ payment methods

Coverage across 200+ currencies and 95 markets

Practical Use Case

A Shopify merchant sells fashion across Europe and Asia. Card payments perform well in the UK. German shoppers prefer local bank transfers. Asian buyers expect digital wallets.

Use case comparison

Checkout inconsistency reduces trust

Reporting remains fragmented

One integration supports all regions

Native Shopify checkout remains intact

Sales scale without added complexity

Why CartDNA Matters in Shopify Payment Orchestration

CartDNA focuses exclusively on Shopify payment apps and orchestration. Merchants gain direct access to local and global payment methods without altering checkout flows. The team understands Shopify approval rules, PCI compliance, and regional payment behavior, allowing integrations to go live faster and perform better.

How CartDNA Supports Payment Orchestration

CartDNA builds Shopify payment apps designed specifically for Shopify checkout. Merchants expand payment choice while maintaining a consistent checkout experience.

CartDNA capabilities

Multi-currency support

Fraud prevention systems

Analytics and reporting tools

Ongoing technical support

Why Payment Orchestration Shapes Shopify’s Future

Shopify continues expanding globally. Payment expectations rise with each new market. Payment orchestration aligns with platform growth and merchant needs.

Future trends list

Demand for localized checkout experiences

Focus on conversion optimization

Increasing regulatory pressure