Cash payments remain a core part of commerce across Latin America. While digital payments continue to grow, millions of consumers still rely on cash for daily spending, bill payments, and online purchases completed through offline cash networks.

For global brands, understanding how cash payments work and how they differ by country is essential for market entry, conversion optimization, and long-term growth in the region.

This article explains what cash payments are, how the process works, which alternative payment methods (APMs) dominate Latin America, and the benefits and limitations for both merchants and customers.

What Is a Cash Payment and How Does the Process Work?

A cash payment is a transaction completed using physical currency rather than cards or digital wallets. In Latin America, cash payments often support both offline and online commerce.

For online purchases, cash payments usually follow an offline settlement model. The customer places an order online, receives a payment reference or barcode, and then completes the payment in cash at an authorized physical location.

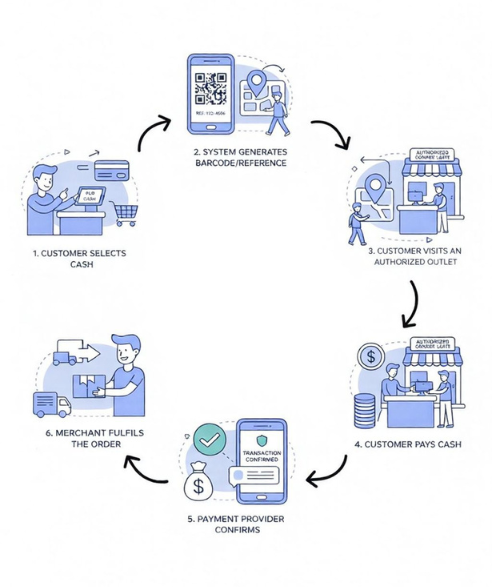

Typical Cash Payment Process

- The customer selects a cash-based payment option at checkout

- The system generates a barcode or reference number

- The customer visits a nearby authorized outlet

- The customer pays the amount in cash

- The payment provider confirms the transaction

- The merchant fulfills the order

This process allows consumers without bank accounts or cards to shop online while using cash.

Latin America Countries and Cash-Based APMs.

Cash-based APMs vary by country. Each solution connects online merchants with offline payment locations.

Below are key countries, their local currencies, and major cash-supported APMs.

Cash Payment Methods Across Latin America

Cash Payments in Mexico

Cash remains one of the most widely used payment methods in Mexico, especially for everyday purchases and online transactions through offline networks. Consumers can pay at convenience stores, supermarkets, and authorized payment outlets using systems like OXXO Pay, PayCash, and Paynet. These networks generate payment references online, which customers then settle in cash, allowing merchants to reach unbanked and underbanked consumers while providing a trusted and accessible payment option across urban and rural areas.

Popular Cash payments in Mexico

- Oxxo Direct

OXXO Direct, allows customers to complete online purchases by paying cash at OXXO convenience stores across the country. The wide national coverage of these outlets makes cash payments accessible in both urban and rural areas. - Paynet

Paynet allows customers in Mexico to pay online purchases in cash at participating stores nationwide. It provides access to ecommerce for consumers without bank accounts or credit cards. - PayCash

PayCash enables customers to generate a payment reference online and settle the transaction in cash at authorized payment locations. These systems offer broad national coverage and make cash payments accessible to both urban and rural consumers.

Cash payments in Brazil

Cash remains a key payment method in Brazil, particularly for online and everyday transactions. Consumers can pay using Boleto Bancário,Elo or Pix , which generate a payment reference that can be settled at banks, lottery outlets, or authorized agents. These systems allow merchants to reach consumers without bank accounts or cards, while providing a trusted, widely accepted way to complete transactions across both urban and rural areas.

Popular cash payments in Brazil

- Boleto Bancario

Boleto Bancário is a popular cash-based payment method in Brazil that lets customers pay online purchases using a generated payment slip. Customers can settle the slip in cash at banks, lottery outlets, or authorized agents, making it accessible for those without cards or bank accounts. - PayCash

PayCash enables customers to generate a payment reference online and settle the transaction in cash at authorized payment locations. These systems offer broad national coverage and make cash payments accessible to both urban and rural consumers. - Pix

Pix is Brazil’s instant payment system that allows consumers to transfer funds and pay for goods and services in real time, 24/7, using the Brazilian Real (BRL). While primarily digital, Pix also supports cash-based settlement through participating bank branches or agents, making it accessible to consumers without cards. Its speed, low cost, and widespread adoption have made it a key payment method for both online and offline transactions.

Cash payments in Argentina

Cash remains a dominant payment method in Argentina, especially for everyday transactions and online purchases completed through offline networks. Consumers commonly use Cabal Express, Naranja and PagoFácil, which generate a payment reference online that can be settled in cash at thousands of physical outlets nationwide. These systems provide accessibility for consumers without bank accounts or cards and allow merchants to reach both urban and rural markets while maintaining trusted payment options.

Popular cash payments in Argentina

- Cabro Express

Cobro Express is one of Argentina’s largest cash payment and collection networks, allowing consumers to pay bills, online purchases, and other services in cash at thousands of authorized locations across the country. Customers receive a payment reference and then settle it in cash at Cobro Express outlets, convenience stores, or partner agents, making it accessible for those without bank accounts or cards. With wide geographic coverage and 24/7 service in many locations, Cobro Express helps merchants reach a broader base of cash-preferred customers nationwide - Pagofacil

PagoFácil is a leading cash-based payment network in Argentina that allows consumers to settle online purchases and bills at physical locations. Customers receive a payment reference online and can pay in cash at convenience stores, kiosks, or authorized outlets. This method provides accessibility for those without bank accounts or cards and ensures merchants can reach a broad range of customers nationwide.

Cash payments in Colombia

Cash remains a widely used payment method in Colombia, especially for everyday transactions and online purchases completed through offline networks. Consumers commonly use Efecty, Carulla and Baloto, which allow them to generate a payment reference online and settle the transaction in cash at authorized payment centers, convenience stores, and local agents. These systems provide accessibility for consumers without bank accounts or cards, helping merchants reach both urban and rural markets while offering a trusted and widely accepted payment option.

Popular cash payments in Colombia

- Efecty

Efecty is one of Colombia’s leading cash-based payment networks, allowing customers to pay bills and online purchases in cash at thousands of authorized locations nationwide. By generating a payment reference online, consumers can complete transactions at convenience stores, payment centers, and local agents, making it accessible for those without bank accounts or credit cards. - Baloto

Baloto is a widely used cash-based payment system in Colombia that enables consumers to pay online purchases and bills at authorized outlets. Customers receive a payment reference online and can settle it in cash at convenience stores, pharmacies, and payment centers nationwide. This method ensures accessibility for consumers without bank accounts or cards and allows merchants to reach a broader customer base. - Carulla

Carulla is a major supermarket chain in Colombia that also serves as a cash payment outlet for online purchases and bill payments through affiliated payment networks. Customers can generate a payment reference online and settle the amount in cash at Carulla stores, providing convenient access for consumers without bank accounts or cards. This makes Carulla an important partner for merchants targeting cash-preferred shoppers in both urban and suburban areas.

Cash payments in Chile

Cash continues to play a key role in Chile, particularly for everyday transactions and online purchases completed through offline networks. Consumers commonly use Servipag, Paycash and Sencillito, which allow them to generate a payment reference online and pay in cash at authorized outlets, bank branches, and convenience stores. These systems provide access for consumers without bank accounts or cards and help merchants reach both urban and rural markets with a trusted and widely accepted payment option.

Popular cash payments in Chile

- Servipag

Servipag is a widely used cash-based payment network in Chile that allows customers to pay bills and online purchases in cash at authorized outlets nationwide. By generating a payment reference online, consumers can settle transactions at convenience stores, banks, and payment centers, making it accessible for those without bank accounts or cards and helping merchants reach a broad customer base. - PayCash

PayCash is a cash-based payment solution in Mexico that allows customers to pay online purchases in cash at authorized stores and retail outlets. Consumers receive a payment reference online, which they can settle at participating locations, making it accessible for those without bank accounts or credit cards and helping merchants reach a wider audience. - Sencillito

Sencillito is a Chilean cash payment platform that enables consumers to pay bills and online transactions in cash at a wide network of physical points throughout the country. Users can generate a payment reference online and then complete the payment in person at authorized outlets, giving access to essential services for those without bank accounts or cards and helping merchants reach more customers with a trusted local payment option.

Cash payments in Peru

Cash remains an important payment method in Peru, particularly for everyday transactions and online purchases completed through offline networks. Consumers commonly use PagoEfectivo, Mercado pago and Oh! pay, which allows them to generate a payment reference online and pay in cash at banks, convenience stores, and authorized retail outlets nationwide. This system provides access for consumers without bank accounts or cards and helps merchants reach both urban and rural markets while offering a trusted and widely accepted payment option.

Popular cash payments in Peru

- PagoEfectivo

PagoEfectivo is a popular cash-based payment network in Peru that allows customers to pay online purchases and bills in cash at authorized locations such as banks, convenience stores, and retail outlets. By generating a payment reference online, consumers without bank accounts or cards can complete transactions securely, giving merchants access to a broader audience across both urban and rural areas. - Payvalida

PayValida is a cash-friendly payment platform in Peru that lets customers pay for online purchases and bills in cash at authorized partner outlets. After generating a payment reference online, consumers can settle it at participating stores, banks, or convenience locations, providing a practical option for users without bank accounts or cards while helping merchants expand their reach across diverse markets. - Paycash

PayCash is a cash-based payment solution available in Peru that allows customers to pay for online purchases in cash at authorized retail outlets and partner locations. After a payment reference is generated online, consumers can settle the amount in person, offering a convenient option for users without bank accounts or cards and helping merchants reach a wider audience across both urban and rural areas.

Cash payments in Ecuador

Cash remains a key payment method in Ecuador, especially for everyday transactions and online purchases completed through offline networks. Consumers commonly use PayValida, Pago efectivo and Banco Guayaquil, which allow them to generate a payment reference online and settle the transaction in cash at authorized outlets, bank branches, and retail partners. These systems provide accessibility for consumers without bank accounts or cards and help merchants reach both urban and rural markets with a trusted and widely accepted payment option.

Popular cash payments in Ecuador

- Red activa

Red Activa is one of Ecuador’s largest non‑bank transactional networks, providing cash payment services across the country. Operated in partnership with Western Union, the network has hundreds of own locations and thousands of franchised outlets where customers can settle payments in cash for online purchases, public services, and other transactions. Shoppers generate a payment reference online and visit a Red Activa outlet to complete the cash payment, offering accessibility for consumers without bank accounts or cards and helping merchants expand their reach nationwide. - Pago efectivo

PagoEfectivo is a popular cash-based payment network in Ecuador that enables customers to pay online purchases and bills in cash at authorized outlets, including banks, retail stores, and convenience stores. By generating a payment reference online, consumers without bank accounts or cards can complete transactions securely, providing merchants with access to a broader customer base across urban and rural areas. - Banco Guayaquil

Banco Guayaquil offers a cash-based payment solution in Ecuador, allowing customers to pay online purchases and bills in cash at its branches and authorized partner outlets. Customers can generate a payment reference online and settle it in person, providing access for consumers without bank accounts or credit cards and helping merchants reach a wider audience across urban and rural areas.

Benefits and Disadvantages of Cash Payments

For Merchants

| Aspect | Benefits | Disadvantages |

|---|---|---|

| Market Reach | Accesses unbanked and underbanked customers | Limited adoption among fully digital users |

| Trust | Builds trust in cash-preferred markets | Slower trust-building in digital-first segments |

| Chargebacks | No card chargebacks or fraud reversals | Dispute handling can be manual |

| Payment Access | Enables ecommerce without card dependency | Requires integration with local cash APMs |

| Risk Exposure | Lower fraud risk compared to cards | Payment confirmation can be delayed |

| Revenue Growth | Improves conversion in cash-heavy regions | Abandoned orders if customers fail to complete cash payment |

| Operations | Predictable settlement once paid | Reconciliation may be slower than instant digital methods |

For customers

| Aspect | Benefits | Disadvantages |

|---|---|---|

| Accessibility | No bank account or card required | Requires physical visit to an outlet |

| Spending Control | Full visibility and control over expenses | Less convenience than instant digital payments |

| Security | No card or personal data exposure | Risk of losing cash before payment |

| Trust | Familiar and widely accepted method | Payment confirmation is not immediate |

| Inclusion | Enables participation in online commerce | Limited availability outside supported outlets |

| Budgeting | Helps manage spending in cash-based households | Refunds can take longer than digital methods |

| Availability | Works across urban and rural areas | Outlet operating hours may vary |

Cash payments trade speed for accessibility. For many Latin American consumers, accessibility comes first.

Why Cash Still Matters in Latin America

Cash remains essential due to:

- Large unbanked populations

- Strong informal economies

- Economic volatility and inflation

- Trust issues with financial institutions

- Limited digital infrastructure in rural areas

In many households, income is earned in cash and spent the same way. Payment habits follow income realities.

Cash Payment Outlets Customers Use

Cash payments in Latin America are completed through a wide network of physical outlets, giving consumers without bank accounts or cards a way to participate in online and offline commerce. Customers typically generate a payment reference online, which they then take to authorized locations to settle in cash. These outlets include convenience stores, supermarkets, bank branches, lottery shops, pharmacies, retail partners, and dedicated payment centers. By providing multiple accessible locations, these networks ensure that cash remains a trusted, widely used, and convenient payment method across both urban and rural areas.

Common Cash Payment Outlets

- Convenience stores

- Supermarkets

- Lottery shops

- Pharmacies

- Bank branches

- Payment kiosks

- Authorized bill payment centers

- Postal service locations (in some countries)

These outlets act as the final step in the online cash payment journey.

Authorized Retail Payment Locations

These are authorized retail locations where you can pay in cash using a payment reference generated at checkout. Rather than paying online, you can head to participating supermarkets, convenience stores, pharmacies, or partner banks to settle the payment in cash. Once the payment goes through, a confirmation is sent to the merchant, letting your order or service proceed.

| 7-Eleven | Soriana | Farmacias del Ahorro | Neto | Kiosko |

| Circle K | Extra | YZA (Farmacias YZA) | Walmart | Walmart Express |

| Bodega Aurrera | Sam’s Club | City Club | Farmacias Roma | Calimax |

| VIA (Vía Recaudación / VIA convenience stores) | Alianza | SYStienda | Financiera Bienestar | Caja Oblatos |

| Abarrey | 7-24 Mix | Afirme | BBVA | Santander |

| Banorte |

What This Means for Global Brands

Global brands entering Latin America must design payment strategies that reflect local behavior.

Cash should not be treated as a fallback. It should be treated as a core payment method.

Brands that support local APMs:

- Increase conversion rates

- Reach unbanked customers

- Build trust faster

- Reduce payment abandonment

Brands that ignore cash exclude millions of potential buyers.

Cash payments continue to power daily commerce across Latin America. They bridge the gap between online platforms and offline realities.

For global brands, success in the region depends on understanding how cash works, which APMs dominate each country, and where customers complete their payments. The future of Latin American payments is hybrid. Digital growth will continue. But cash will remain essential.

Brands that adapt will grow. Brands that ignore cash will fall behind.